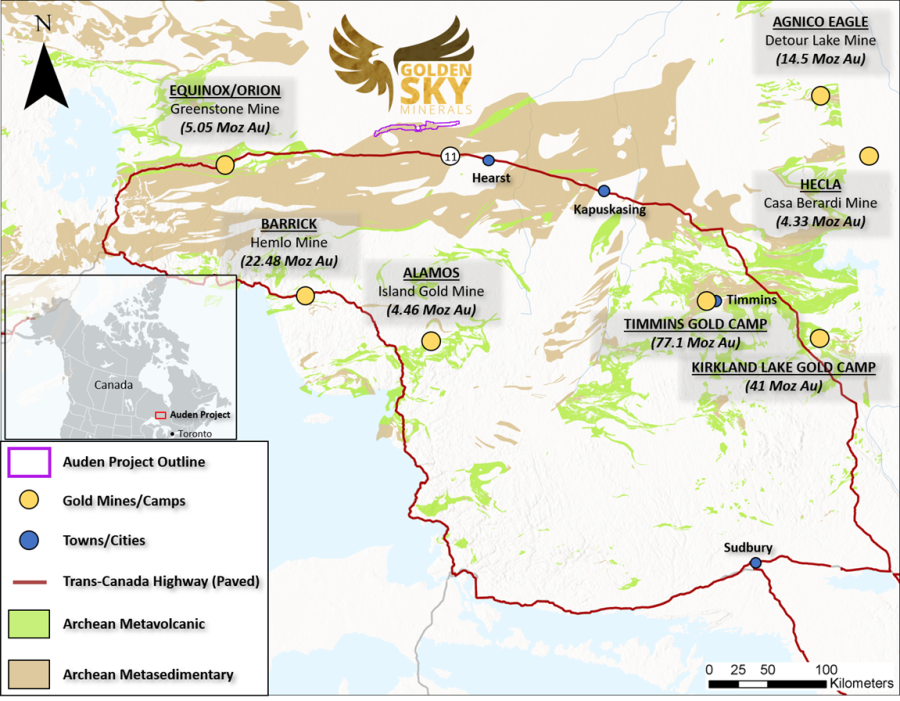

VANCOUVER, British Columbia, Nov. 27, 2023 (GLOBE NEWSWIRE) — Golden Sky Minerals Corp. (AUEN.V) (the “Company” or “Golden Sky”) is pleased to announce that, through staking, the Company has acquired the district-scale 26,300-hectare Auden Gold Property ~50 km east of the Beardmore-Geraldton Greenstone Belt, Ontario, Canada (Figure 1). The Property is 100% owned by Golden Sky with no underlying royalties. The Auden Property is located in an underexplored region that is primarily underlain by an east-west trending sequence of mafic metavolcanics, metasediments, and iron formation that shares many geological similarities with other major orogenic gold camps in the region. The most important feature of the property, the Auden Structural Zone, is a significant east-west trending fault interpreted to be an eastward extension of the gold-producing Beardmore-Geraldton structural system (Figure 2).

With a similar geological setting to Equinox/Orion’s Greenstone Gold Mines (5.05 Moz Au), Agnico Eagle’s Detour Lake Mine (20.6 Moz Au) and other orogenic camps, including the Timmins and Kirkland Lake camps, Golden Sky believes there is high potential for the expansion and discovery of new gold targets on the property. The road-accessible Auden Gold Property is located approximately 65 km northwest of Hearst, Ontario, and is in close proximity to the paved Highway 11.

Auden Property Highlights:

- District-scale opportunity with 26,300 hectares that covers a ~70 km strike-length of the Auden Structural Zone, which has historically been interpreted to be an extension of the Beardmore-Geraldton structural system. The zone remains largely untested despite anomalous gold values being recorded from drilling and surface rock samples.

- Due to extensive overburden cover in the region (<5% outcrop), past operators relied heavily on geophysical survey results followed by early-phase exploration drilling with widely-spaced holes over several kilometers. Within the property area, 58 historical drill holes have been recorded. These early drill programs were typically limited to following up on ground-based geophysical targets, as the first large-scale airborne geophysical survey was not conducted until 1993. Though limited in scope, the drilling successfully demonstrated that precious metal mineralization is associated with a major east-west oriented structure that extends ~70 km (Auden Structural Zone) (Figure 3).

- Some of the earliest recorded drilling was by the Fatima Mining Company Ltd. from 1956 to 1958. These holes are located in the western portion of the property. A total of 20 drill holes were spaced over 15 km of sheared and folded metasediments, quartz porphyry and iron formation (Figure 4). Almost every hole intersected zones of carbonate alteration, quartz veining, and semi-massive to disseminated sulphides. There is no report of gold assays, as the focus was on base metals. In 1990, McKinnon Prospecting conducted a field visit that included reanalysis of a few samples of Fatima Mining’s core. One sample of semi-massive coarse-grained pyrite-pyrrhotite mineralization assayed 367 ppb gold and 250 ppm arsenic, which highlights the prospectivity for gold mineralization in the area.

- In 1965, Colleen Copper Mines Ltd. explored around the Nagagami River in a zone of metavolcanics, conglomerate, iron formation and quartz porphyry with semi-massive to disseminated sulphides. A grab sample assayed 25 g/t Au and 2.36% Cu (unverified). A follow-up 4-hole drill program that focused on base metal exploration disclosed only two reported assays, both from Hole CC4 (0.41% Cu over 1.5 m and 0.1% Cu over 1.5 m) (Figure 5).

- From 1976-1978, Shell Canada Resources Ltd. conducted a regional program but never filed this work for assessment credit. Shell successfully delineated a regional structure that was later termed the Auden Structural Zone. An estimated 12 holes were drilled in the region; in spite of strong alteration and the presence of arsenopyrite-pyrite-pyrrhotite mineralization, no assay results were recorded. In 1993 McKinnon Prospecting compiled the Shell data and collected 48 samples to analyze for gold and arsenic. The gold assays ranged from 19 ppb Au to 1,277 ppb Au. In drillhole S78.04, one section of highly deformed pyrrhotite-rich, arsenopyrite-bearing iron formation assayed 0.670 g/t Au over 16.9 m (Figure 5).

- The most recent significant exploration occurred from 1988-1993 by McKinnon Prospecting, who was the first to conduct a comprehensive, property-wide airborne VLF-EM geophysical survey which highlighted 34 target areas. A follow-up 17-hole drill program provided critical insight into the geology of the region and either extended or discovered several strongly altered shear zones with anomalous precious metal values. One of the most compelling magnetic and electromagnetic (EM) geophysical targets was tested by holes MP-17-1, MP-14-1 and MP-13-1, collared at multi-kilometric intervals along an 8-km east-west trend (Figure 5). The most westerly hole, MP-17-1, intersected a 27 m wide zone of pyrrhotite-rich iron formation that was selectively sampled, returning encouraging assays of 3.33 g/t Au over 1.2 m, 1.22 g/t Au over 1.5 m, and 1.54 g/t Au over 0.7 m. Hole MP-14-1 was collared 1.5 km to the east and intersected anomalous gold values over several metres, with the highest value of 0.8 g/t Au over 1.3 m. Hole MP-13B-1 was collared 2.7 km east of MP-14-1 and returned an assay of 0.19 g/t Au over 0.95m. These 3 holes intersected similar geology over ~4.2 km. The continuity of these rock units is further supported by airborne magnetic geophysics, which highlights the potential for further exploration along this trend.

- Nearby infrastructure includes an extensive back-country road network, electric power grid, paved Highway 11, rail access, and local accommodations in Hearst, Ontario (2021 pop: 4,794), located 60 km to the southeast. These factors support very cost-effective exploration.

John Newell, President and CEO of Golden Sky Minerals, states: “The acquisition of a new mineral exploration property near the renowned Geraldton-Beardmore gold district in northern, Ontario, marks a significant expansion for Golden Sky Minerals. This area is noted for its prolific gold production, making it a strategic choice for the company, outside of the Canadian cordillera. With this latest acquisition, Golden Sky Minerals has diversified its exploration portfolio across three of Canada’s most prolific mineral districts: Beardmore-Geraldton, Ontario; the Quesnel Trough, BC; and the Tintina Gold Belt, Yukon. This diversification demonstrates the company’s comprehensive approach to mineral exploration and its commitment to pursuing a variety of opportunities in various geological settings.”

About Golden Sky Minerals Corp.

Golden Sky Minerals Corp. is a well-funded junior grassroots explorer engaged in the acquisition, assessment, exploration, and development of mineral properties located in highly prospective areas and mining-friendly districts. Golden Sky’s mandate is to develop its portfolio of Properties to the mineral resource stage through systematic exploration.

The drill-ready Properties include Hotspot and Lucky Strike, both in Yukon, Canada. In addition, the drill-ready Rayfield Copper-Gold Property in southern British Columbia, and the staking of the Auden Property in Ontario, add to the company’s substantial early-stage Canadian Property pipeline.

The company was incorporated in 2018 and is headquartered in Vancouver, British Columbia, Canada.

More information can be found at the Company’s website at www.goldenskyminerals.com.

ON BEHALF OF THE BOARD

John Newell, President and Chief Executive Officer

Carl Schulze, P. Geo., Consulting Geologist with Aurora Geosciences Ltd, is a qualified person as defined by National Instrument 43-101 for Golden Sky’s Ontario, Yukon and British Columbia exploration Properties, and has reviewed and approved the technical information in this release.

For new information from the Company’s programs, please visit Golden Sky’s website at www.GoldenSkyMinerals.com or contact John Newell by telephone (604) 568-8807 or by email at info@goldenskyminerals.com or john.newell@goldenskyminerals.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation. In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as “anticipates”, “expects”, “understanding”, “has agreed to” or variations of such words and phrases or statements that certain actions, events or results “would”, “occur” or “be achieved”. Although Golden Sky has attempted to identify important factors and risks that could affect Golden Sky and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended, including, without limitation: inherent risks involved in the exploration and development of mineral properties; the uncertainties involved in interpreting drill results and other exploration data; the potential for delays in exploration or development activities; the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with Golden Sky’s expectations; accidents, equipment breakdowns, title and permitting matters; labour disputes or other unanticipated difficulties with or interruptions in operations; fluctuating metal prices; unanticipated costs and expenses; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on its Properties; that Golden Sky may not be able to confirm historical exploration results and other risks set forth in Golden Sky’s public filings at www.sedar.com. In making the forward-looking statements in this news release, Golden Sky has applied several material assumptions, including the assumption that general business and economic conditions will not change in a materially adverse manner. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Golden Sky does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.